A mortgage rate is the interest rate charged on a home loan, expressed as an annual percentage rate (APR). This rate directly impacts the monthly mortgage payment, which includes principal and interest, and may also factor in property taxes and insurance for an estimated monthly payment.

Mortgage rates fluctuate based on current economic conditions and the broader financial markets. While the Federal Reserve's policies influence general borrowing costs, the actual mortgage rate offered to a borrower depends on several factors, including the individual's credit score, debt to income ratio, loan amount, down payment, and overall credit profile.

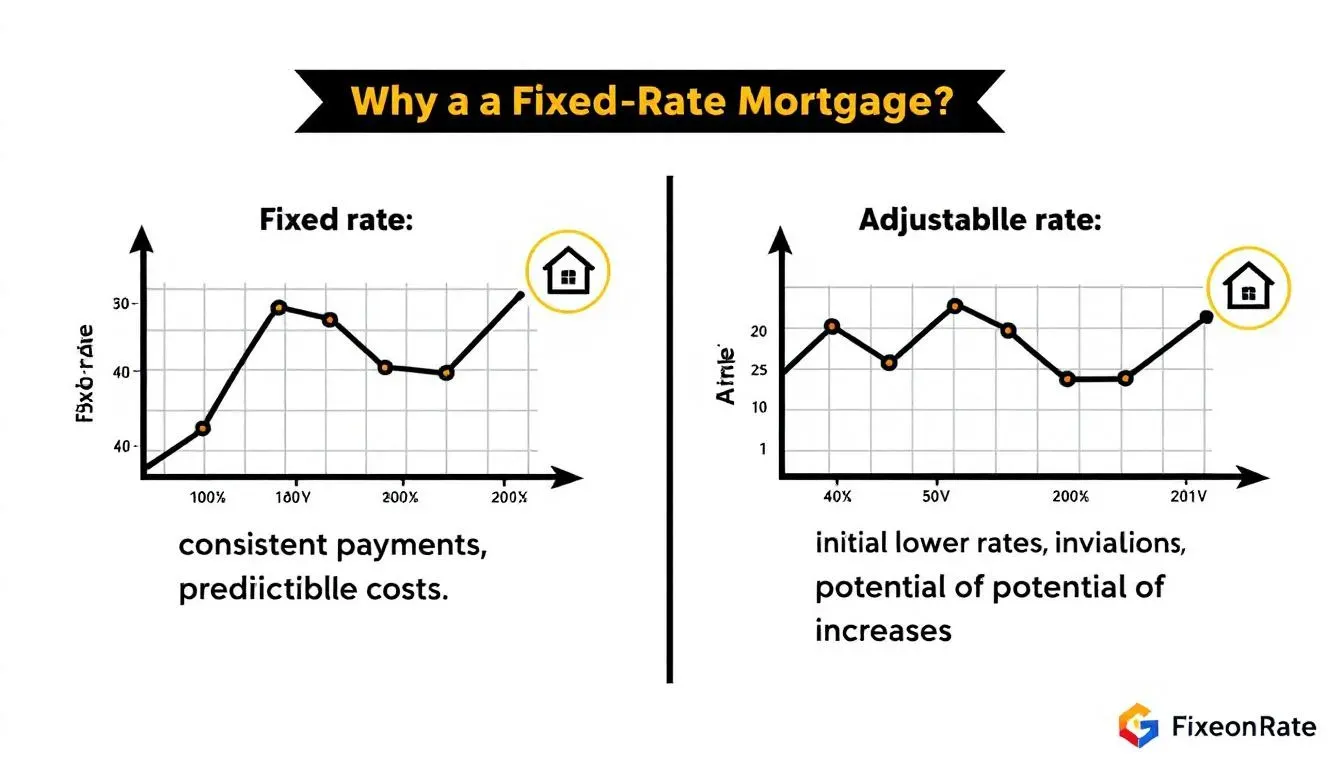

Homebuyers can select from various mortgage programs, primarily fixed-rate mortgages and adjustable rate mortgages (ARMs). A fixed rate mortgage, such as a 30 year fixed rate, maintains the same interest rate and monthly payments throughout the loan term, providing stability and predictability. In contrast, an adjustable rate mortgage features an initial fixed rate period, after which the interest rate adjusts periodically during the adjustment period, causing monthly payments to fluctuate based on market conditions.

Understanding mortgage points, including discount points and origination fees, is essential as these can affect the mortgage interest rate and closing costs. Paying mortgage points upfront can lower the interest rate, potentially reducing the overall cost of the loan.

Potential borrowers should also consider factors like loan approval criteria, including credit score requirements and the impact of personal finance elements such as income and debt. Monitoring current mortgage rates and locking in a locked rate during the lock period can secure favorable terms in a changing market.

By comparing offers from multiple lenders and understanding the components of mortgage rates, including annual percentage rate and fees, homebuyers and those looking to refinance can make informed decisions to optimize their monthly mortgage payments and overall loan costs.

The prevailing mortgage rate is a primary consideration for homebuyers seeking to purchase a home using a loan. The rate a homebuyer gets has a substantial impact on the amount of the monthly payment that they will pay.

Mortgage rates are highly sensitive to economic conditions. Since 1980, average mortgage rates for a 30-year fixed-rate mortgage have hit a high of 18.63%, during a period of runaway inflation in 1981, and a low of 2.67% in 2020, in the early days of the COVID-19 pandemic. At the end of May 2025, the average national rate was 6.89%.

Let's consider a home with a purchase price of $800,000. Suppose a buyer makes a 20% down payment of $160,000, resulting in a loan amount of $640,000. Assuming a 30-year fixed rate mortgage with an interest rate of 6.5%, the estimated monthly payment (including principal and interest) would be approximately $4,048. This estimate does not include property taxes, homeowners insurance, or other potential costs such as mortgage insurance or HOA fees, which would increase the total monthly payment.

If the buyer opts for an adjustable rate mortgage (ARM) with an initial fixed rate period of 5 years at a lower rate of 5.75%, the initial monthly payment would be about $3,738. However, after the initial fixed period, the rate may adjust annually based on market conditions, potentially increasing monthly payments.

This example illustrates how mortgage rates and loan terms directly affect monthly payments and overall affordability for homebuyers.

As a borrower, it's crucial to monitor key indicators that influence mortgage rates to make informed decisions about your home loan. One primary indicator is the prime rate, which reflects the lowest average interest rate banks offer for credit. This rate is closely tied to the Federal Reserve’s federal funds rate and typically runs about 3% higher. Understanding the prime rate helps borrowers gauge the baseline cost of borrowing from banks.

Another vital indicator is the 10-year Treasury bond yield, which signals broader market trends in interest rates. When the 10-year Treasury yield rises, mortgage rates generally increase as well; conversely, when it falls, mortgage rates tend to drop. Since many mortgages are paid off or refinanced within a 10-year period, this yield serves as a practical benchmark for borrowers assessing long-term mortgage costs.

Additionally, staying updated on weekly mortgage rate trends, such as those published by Freddie Mac, can provide borrowers with timely insights into current market conditions. By keeping an eye on these key indicators—the prime rate, the 10-year Treasury bond yield, and weekly mortgage rate updates—borrowers can better anticipate changes in mortgage rates and plan their home financing strategies accordingly.

A lender assumes a level of risk when issuing a mortgage, as there is always the possibility that a borrower may default on the loan. To mitigate this risk, lenders carefully evaluate several factors when determining an individual's mortgage rate. Generally, the higher the perceived risk, the higher the mortgage rate offered. This higher interest rate helps ensure that the lender can recoup the loan amount more quickly in the event of default, thereby protecting the lender's financial investment.

One of the most critical factors influencing mortgage rates is the borrower's credit score. A higher credit score reflects a strong financial history and a greater likelihood of timely repayment, which allows lenders to offer a lower interest rate. Conversely, borrowers with lower credit scores are often charged higher rates to compensate for the increased risk. Additionally, the loan size and loan amount requested by the borrower also impact the mortgage rate; larger loans or jumbo loans may carry different rates compared to conforming loans.

Other key considerations include the borrower's debt to income ratio, down payment amount, and overall credit profile. For example, a larger down payment can reduce the lender's risk and result in a lower mortgage interest rate. Loan approval also depends on these factors, which collectively influence the actual rate a borrower receives.

Mortgage rates are also affected by broader economic factors and financial markets. The central bank's policies, particularly those of the Federal Reserve, play a significant role in setting the tone for mortgage interest rates, although the Fed does not directly set mortgage rates. Market indicators such as the 10-year Treasury bond yield and data ranges published daily provide insight into current mortgage rate trends.

For first time homebuyers and veterans affairs loan applicants, special mortgage programs backed by the federal housing administration or veterans affairs can offer competitive rates and lower down payment requirements. These programs often come with different terms and may influence the monthly payments shown in loan estimates.

In summary, determining a mortgage rate is a complex process that balances individual borrower risk factors with broader economic conditions. Understanding these elements can help prospective borrowers navigate the housing market more effectively and secure favorable mortgage rates that fit their financial situation.

A fixed-rate mortgage offers stability and predictability, providing borrowers with a consistent monthly mortgage payment throughout the entire loan term. This means your interest rate and monthly payments remain unchanged, regardless of fluctuations in mortgage rates or broader financial markets. This option is ideal for those who value long-term budgeting certainty and want to avoid the risk of rising interest rates. Additionally, if mortgage rates drop, borrowers can take advantage of refinancing opportunities to secure a lower interest rate.

In contrast, an adjustable rate mortgage (ARM) typically starts with a lower interest rate compared to a fixed rate mortgage, which can result in lower initial monthly payments and reduced closing costs. This lower initial rate, often during the initial fixed rate period, makes ARMs attractive for homebuyers who expect to sell or refinance before the adjustment period begins. However, after this initial period, the interest rate adjusts periodically based on current mortgage rates and market conditions, which can cause monthly mortgage payments to increase or decrease. While ARMs offer the benefit of lower starting costs and potential savings, they come with the risk of higher payments if interest rates rise during the adjustment period.

Choosing between a fixed rate mortgage and an adjustable rate mortgage depends on your financial situation, risk tolerance, and plans for the property. Fixed-rate mortgages provide peace of mind with stable monthly payments and protection against interest rate increases, making them suitable for long-term homeowners. Adjustable rate mortgages offer the advantage of lower initial interest rates and monthly payments, which can be beneficial for those anticipating changes in their housing needs or expecting mortgage rates to remain stable or decline.

Mortgage rates are calculated based on a combination of broader economic factors and individual borrower characteristics. Key economic influences include the yields on government bonds, such as the 10-year Treasury bond, which often serve as a benchmark for mortgage rates. When these yields rise or fall, mortgage rates tend to move in the same direction. Additionally, Federal Reserve policies impact overall borrowing costs, indirectly affecting mortgage rates, though the Fed does not set these rates directly.

Lenders also evaluate borrower-specific factors to determine the mortgage rate offered. These include the borrower's credit score, debt to income ratio, loan amount, down payment size, and overall credit profile. Higher credit scores and larger down payments typically result in lower interest rates because they reduce the lender's risk. The type of loan program, such as fixed rate mortgage or adjustable rate mortgage, and the loan term also influence the rate.

Borrowers may choose to pay mortgage points, including discount points and origination fees, upfront to lower their interest rate. Closing costs and fees are also factored into the annual percentage rate (APR), reflecting the total cost of the loan.

In essence, mortgage rates are set by balancing market conditions, economic indicators, and individual risk factors to arrive at a rate that is competitive yet compensates lenders for the risk of lending.

Everyone wants to secure a low mortgage interest rate. Here are some effective strategies to help you achieve that:

Private mortgage insurance (PMI) is a type of insurance that protects the lender if a borrower defaults on a conventional mortgage loan. It is usually required when the down payment is less than 20% of the home’s purchase price. PMI enables borrowers to obtain a mortgage with a smaller down payment but adds an extra cost to the monthly mortgage payment. This insurance safeguards the lender, not the borrower. Once the borrower accumulates sufficient equity—typically 20% or more—PMI can often be canceled, reducing the overall monthly payment.

A mortgage rate is the interest charged to a homebuyer to finance their purchase. The best rates are typically offered to those with excellent credit scores and a strong financial history demonstrating their ability to repay the loan. However, the range of available mortgage rates at any given time is largely influenced by prevailing interest rates, which fluctuate weekly based on economic conditions.